Quantifying Hurricane Risk

Tropical cyclones, known regionally as hurricanes, typhoons, or cyclones, are a significant source of annual catastrophe risk globally. Moody's RMS hurricane modeling helps the market quantify risk to inform sound underwriting, portfolio management, and risk transfer decisions.

Capture the Full Loss Potential

Assess risk across the full spectrum of landfalling, bypassing, and transitioning storms. Moody's RMS hurricane models are informed by extensive stochastic event sets and landfall rates specific to each basin or region.

Improve Risk Selection

Select and manage risk utilizing the latest Moody's RMS catastrophe modeling. Moody's hurricane models incorporate advanced wind and water modeling methodologies to generate realistic representations, variations, and correlations of hurricane hazard within each region.

Better Risk Differentiation

Differentiate risks within and across regions, sub-perils, building characteristics, and mitigation efforts. At Moody's we model hurricane risk by including hundreds of unique vulnerability curves informed by localized hazard data, regional differences in building codes or construction, and insights from recent and historical events.

Tropical Cyclone Models

Regional Models

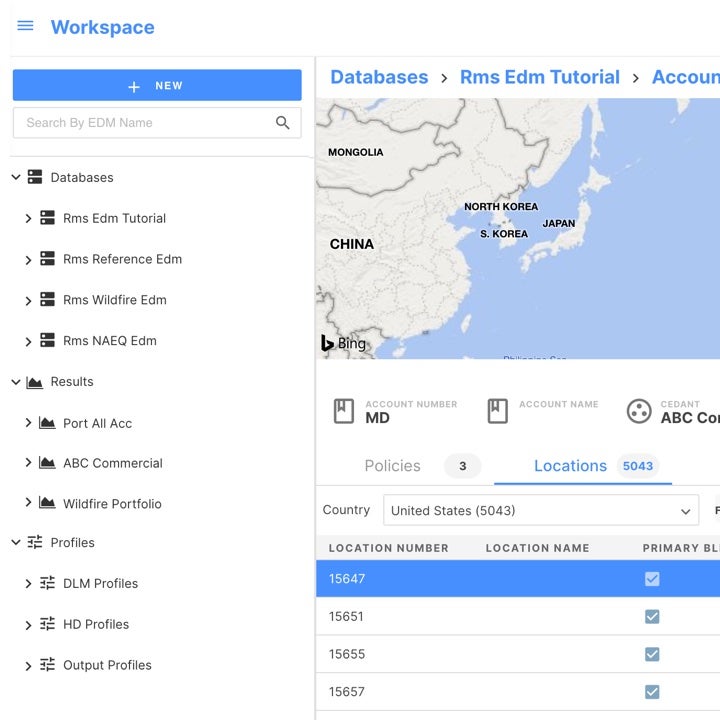

Click a region on the interactive map to see coverage.

North America Tropical Cyclone

Asia-Pacific Tropical Cyclone

-

Australia

-

China

-

Guam

-

Hong Kong

-

Japan

-

Macau

-

Philippines

-

South Korea

-

Taiwan

Latin America Tropical Cyclone

- Caribbean

-

Anguilla

-

Antigua & Barbuda

-

Aruba

-

Bahamas

-

Barbados

-

Bermuda

-

Bonaire

-

British Virgin Islands

-

Cayman Islands

-

Cuba

-

Curacao

-

Dominica

-

Dominican Republic

-

Grenada

-

Guadeloupe

-

Haiti

-

Jamaica

-

Martinique

-

Montserrat

-

Puerto Rico

-

Saba

-

Sint. Maartin

-

St. Barthelemy

-

St. Eustatius

-

St. Kitts and Nevis

-

St. Lucia

-

St. Martin

-

St. Vincent and the Grenadines

-

Trinidad & Tobago

-

Turks & Caicos

-

U.S. Virgin Islands

- Central America

-

Belize

-

Costa Rica

-

Guatemala

-

Honduras

-

Nicaragua

-

Panama

North America

Latin America

Europe

Asia-Pacific

North America Tropical Cyclone

Asia-Pacific Tropical Cyclone

-

Australia

-

China

-

Guam

-

Hong Kong

-

Japan

-

Macau

-

Philippines

-

South Korea

-

Taiwan

Latin America Tropical Cyclone

- Caribbean

-

Anguilla

-

Antigua & Barbuda

-

Aruba

-

Bahamas

-

Barbados

-

Bermuda

-

Bonaire

-

British Virgin Islands

-

Cayman Islands

-

Cuba

-

Curacao

-

Dominica

-

Dominican Republic

-

Grenada

-

Guadeloupe

-

Haiti

-

Jamaica

-

Martinique

-

Montserrat

-

Puerto Rico

-

Saba

-

Sint. Maartin

-

St. Barthelemy

-

St. Eustatius

-

St. Kitts and Nevis

-

St. Lucia

-

St. Martin

-

St. Vincent and the Grenadines

-

Trinidad & Tobago

-

Turks & Caicos

-

U.S. Virgin Islands

- Central America

-

Belize

-

Costa Rica

-

Guatemala

-

Honduras

-

Nicaragua

-

Panama

Industry Leadership

Related Products

Explore a range of weather-related peril models to help you build a full picture of risk and successfully manage your exposure.

Resources

Major Hurricane Ian: How Good Is Your Climate Risk Model?

As the need to understand climate risk grows ever more urgent, asset managers, lenders, corporates, and businesses all need to be confident that their climate risk models can capture the complexity of climate and weather events – in order to satisfy their regulators, boards, and shareholders. Moody’s Climate on Demand has led the way in the provision of climate risk analytics, and during 2023 this innovative solution will deliver new risk metrics that capture the financial impacts of climate risk by integrat...

Will Summer 2022-23 Result in a Season of Tropical Cyclone...

October to April represents the peak period for extreme weather in Australia, with the risk of flooding, tropical cyclones, bushfires, and severe thunderstorms typically higher than at any other time of the year. And looking at this season’s latest outlook it indicates a potentially wet and windy summer for parts of Australia, with an increased risk of tropical cyclones and flooding. Heightened Tropical Cyclone Risk With tropical cyclone activity in the Northern Hemisphere now winding down for the year, me...

Hurricane Ian: Who Pays?

With loss estimates placing Major Hurricane Ian as one of the costliest hurricanes to ever hit the U.S., a question arises around who will pay to repair and reconstruct the tens of thousands of affected Florida properties and compensate businesses for lost income. And just how long will this recovery take? RMS®, a Moody’s Analytics company, has supported the (re)insurance industry with physical climate risk impact models for over 30 years. Through our partnership with insurers, we have a deep understanding of...

Hurricane Nicole: First Florida East Coast Landfall Since ...

It was the turn of Florida’s east coast to receive a landfalling hurricane, as Hurricane Nicole made its U.S. landfall as a Category 1 hurricane this morning, Thursday, November 10, just south of Vero Beach, Florida at 08:00 UTC (03:00 local time). At landfall, Nicole had estimated maximum sustained wind speeds of 75 miles per hour (120 km/h). Surprisingly, there has not been a landfalling hurricane on Florida’s east coast for some 17 years, not since Hurricane Katrina made its first U.S. landfall in August 2...

Rare but Not Unprecedented: Nicole Threatens Florida as a ...

With just over three weeks to go until the official end of the 2022 North Atlantic Hurricane season, Subtropical Storm Nicole – the fourteenth named storm of the year, could be a rarely seen event – a hurricane in November making landfall on Florida’s east coast. Attaining subtropical storm status on Monday, November 7, Nicole is a large storm with tropical-storm-force winds currently extending up to 380 miles (610 kilometers) from the center of the system. Nicole is expected to transition into a tropical sto...

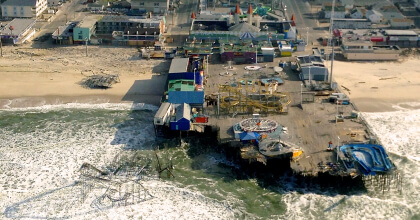

10 Years After Superstorm Sandy: The Paradox of More Flood...

It has been 10 years since Hurricane Sandy, a.k.a. Superstorm Sandy, made its second landfall as a post-tropical storm in Brigantine, a city just north of Atlantic City, New Jersey, at around 8 p.m. local time on October 29, 2012. It remains one of the most destructive, deadly, and costly natural catastrophes in U.S. history. Sandy made its first landfall in Jamaica as a Category 1 hurricane on October 24 and it strengthened to a Category 3 hurricane as it made landfall in Cuba a day later, before weakening ...

Hurricane Ian: The Challenge of Getting Insights into Your...

As soon as Tropical Storm Ian was named on September 26, 2022, our clients using the RMS® ExposureIQ™ application on the RMS Intelligent Risk Platform, have been accessing both our RMS Event Response event footprints and our RMS HWind real-time insights to provide a unique perspective on the progress of the storm. The ninth named tropical storm of the current North Atlantic hurricane season, Major Hurricane Ian made landfall as a Category 4 (Saffir-Simpson Hurricane Windscale) major hurricane near Cayo Costa,...

The Problem of October Hurricanes

While the clean-up in Florida after the colossal damage and disruption from Hurricane Ian gets underway, and while the repair and rebuilding costs are being totaled up, we should not forget that we are still in hurricane season. There is even a low risk of further destructive storms. The hurricane season runs for six months from June 1 to November 30. Eighty percent of intense hurricane U.S. landfalls occur before October but we should not underestimate the potential problems posed by the fifth month o...

Hurricane Ian Makes Final Landfall in South Carolina Accom...

As Hurricane Ian departed into the Atlantic from Florida’s east coast at 12:00 UTC (08:00 Eastern Time ET) Thursday, September 29, it then regained hurricane intensity later that day at 21:00 UTC (17:00 ET). It has made an unwelcome return; the National Hurricane Center (NHC) has announced that surface observations indicated that the center of Hurricane Ian made landfall on Friday, September 30, as a Category 1 hurricane at 14:05 ET (18:05 UTC) near Georgetown, South Carolina (pop, ~9,000). It had maximu...

Hurricane Ian: Strongest Hurricane in Southwest Florida Si...

The eighth named tropical storm of the current North Atlantic hurricane season, Major Hurricane Ian, made landfall as a Category 4 (Saffir-Simpson Hurricane Windscale) major hurricane near Cayo Costa, Florida at 19:05 UTC (15:05 Eastern Time ET) on Wednesday, September 28. Ian remerged into the southeast Gulf of Mexico after leaving Cuba as a Category 3 storm on Tuesday, September 27, and strengthened owing to warm sea surface temperatures and generally low vertical wind shear. It completed an eyewall replac...

Hurricane Ian: A Potential Category Five Hurricane?

A quiet North Atlantic hurricane season has certainly kicked into life, as Hurricane Ian approaches southwest Florida as a high-end Category 4 (Saffir-Simpson Hurricane Wind Scale – SSHWS) major hurricane. This is the ninth tropical storm of the current season and the fourth hurricane. Comparing this season to 2021, the ninth storm was Hurricane Ida in late August – and it was the most destructive of that year. Ian made landfall near La Coloma on the southwest coast of Cuba yesterday (September 27) as a Categ...

30 Years on From Hurricane Andrew: Managing a Storm of Flo...

A version of this blog was published in The Insurer. With some 30 years passed since Hurricane Andrew made landfall as a Category 5 storm on August 24, 1992, near the city of Homestead, Dade County, what can we say has changed over this period? What has gotten better, and what has gotten worse? We start with what has gotten better. First is science and technology. In 1992 insurers relied on the experience of the last Category 5 storm in the market – such as the 1935 Labor Day storm that skirted Florida’s G...

2022 North Atlantic Hurricane Season Halftime Report: The ...

With a few weeks to go until the North Atlantic Basin enters its most active period, now is a good time to recap recent activity, review updated seasonal forecasts, and look ahead to what may be in store for the remainder of the season. A Slow Start to the 2022 Season The North Atlantic Basin has been a little quiet since the start of the hurricane season. So far in 2022, the basin has not produced any hurricanes and just three tropical storms – Alex, Bonnie, and Colin: A tropical depression brought...

What Factors Could Drive Northern Hemisphere Tropical Cycl...

With June 1 heralding the official start of the 2022 North Atlantic hurricane season, Tropical Storm Alex already on the scoreboard, and eight hurricane landfalls in the last two seasons, the question on everyone’s mind is: Will the 2022 North Atlantic hurricane season be as impactful and costly as both 2020 and 2021? And for the Western North Pacific: Will this year yet again be close to the long-term average in terms of the number of storms? We have recently issued an executive summary of the RMS® 2022 Nort...

Lessons from Hurricane Ida: How Catastrophe Modeling Can H...

Flood remains the most underinsured climate risk in the U.S. Consulting firm Milliman estimates that just 4 percent of U.S. homeowners have flood insurance coverage, which is primarily provided by the National Flood Insurance Program (NFIP). With 4.88 million policies, the NFIP provides around US$1.3 trillion in flood coverage. This low flood insurance protection rate is not a surprise, despite the emergence of analytical tools to quantify flood risk and a growing number of companies offering private flood c...

Atlantic Hurricane in 2020: Are We in Store for Another Re...

In the midst of the 2020 Atlantic hurricane season, with storms forming in rapid sequence, records broken early in the season and four storms already producing significant damage in the Caribbean and U.S., whether we are headed for a record-breaking year is a good question. Various forecast agencies have issued mid-season updates, which signal prospects for the remainder of the season. But what about the 2020 season to date, and how does it compare to notably active seasons of the past? In this blog, we’ll co...

New Insights Within the Japan Typhoon and Flood HD Model

Japan lies in the northern reaches of the most active tropical cyclone (typhoon) basin in the world; the western North Pacific. Aspects of Japan’s geography, not least its position, make it susceptible to typhoons. And as one of the world’s largest insurance markets, Japan has significant insured exposure at risk to typhoons. It is within this context that RMS has had a typhoon model for Japan for over 25 years—and have now launched our latest—the RMS Japan Typhoon and Flood HD (High-Definition) Model on Risk Mo...

The Year of the Kitten

Almost three months ago we passed a remarkable record in catastrophe loss. And yet no one seems to want to celebrate it. No banner headlines in the newspapers. No speeches at the Monte Carlo Reinsurance Rendezvous. The first half of 2019 generated the lowest catastrophe insurance loss for more than a decade. The estimates come in at: US$15 billion (Munich Re), US$19 billion (Sigma), or US$20 billion (Aon). In straight dollar terms, independent of any adjustment for inflation or exposure, this is lower t...

How Did the 2017-2018 Hurricanes Affect Medium-Term Rates?

Earlier this year, RMS released its latest medium-term rates (MTR) forecast for the North Atlantic hurricane basin as part of the North Atlantic Hurricane Models Version 18.1 release. Applicable over the 2019-2023 period, the Version 18.1 forecast represents an update from the previous MTR forecast issued in 2017 for the 2017-2021 period, by reflecting hurricane activity from the 2017 and 2018 seasons. The MTR forecast provides a forward-looking estimate of the expected average annual landfall rate on a five-...

Typhoon Hagibis: Japan’s Wettest Typhoon on Record

Japan continues to assess the extent of the damage caused by Typhoon Hagibis, which made landfall near the Izu Peninsula in Shizuoka Prefecture on Saturday, October 12. Current reports state that at least 66 people have been killed, dozens of people are missing, and hundreds are injured. At this time, the worst impacted prefectures include Nagano, Saitama, Shizuoka, and Fukushima. However, the full extent of the damage is not expected to be known for several days as rescue operations and official damage asses...

Northern Bahamas Devastated by Major Hurricane Dorian

Initial reports from the Bahamas suggest that the islands of Great Abaco and Grand Bahama have been left devastated from Major Hurricane Dorian, evoking memories of the destruction on the eastern Caribbean island of Barbuda in the immediate aftermath of Hurricane Irma just two years ago. A Record-Breaking Hurricane for the Bahamas and the Atlantic Dorian underwent an unprecedented period of rapid intensification between August 31 and September 1, that took its maximum sustained wind speed from 150 miles pe...

Need help with hurricane risk modeling?