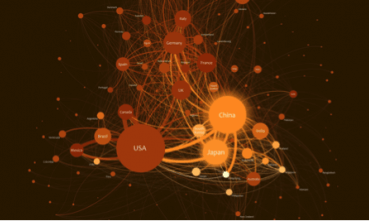

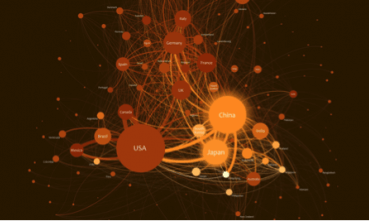

Heraclitus taught us more than 2,500 years ago that the only constant is change. And one of the biggest changes in our lifetime is that everything is interconnected. Today, global business is about networks of connections continents apart.

In the past, insurers were called on to protect discrete things: homes, buildings and belongings. While that’s still very much the case, globalization and the rise of the information economy means we are also being called upon to protect things like trading relationships, digital assets, and intellectual property.

Technological progress has led to a seismic change in how we do business. There are many factors driving this change: the rise of new powers like China and India, individual attitudes and even the climate. However, globalization and technology aren’t just symbiotic bedfellows; they are the factor stimulating the greatest change in our societies and economies.

The number, size, and types of networks are growing and will continue to do so. Understanding globalization and modeling interconnectedness is, in my opinion, the key challenge for the next era of risk modeling. I will discuss examples that merit particular attention in future blogs, including:

- Marine risks: More than 90% of the world’s trade is carried by sea. Seaborne trade has quadrupled in my lifetime and shows no sign of relenting. To manage cargo, hull, and the related marine sublines well, the industry needs to better understand the architecture and the behavior of the global shipping network.

- Corporate and Government risks: Corporations and public entities are increasingly exposed to networked risks: physical, virtual or in between. The global supply chain, for example, is vulnerable to shocks and disruptions. There are no local events anymore. What can corporations and government entities do to better understand the risks presented by their relationships with critical third parties? What can the insurance industry and the capital markets do to provide CBI coverage responsibly?

- Cyber risks: This is an area where interconnectedness is crucial. More of the world’s GDP is tied up in digital networks than in cargo. As Dr. Gordon Woo often says, the cyber threat is persistent and universal. There are a million cyber attacks every minute. How can insurers awash with capital deploy it more confidently to meet a strong demand for cyber coverage?

Globalization is real, extreme, and relentless. Until the Industrial Revolution, the pace of change was very slow. Sure, empires rose and fell. Yes, natural disasters redefined the terrain.

But until relatively recently, virtually all the world’s population worked in agriculture—and only a tiny fraction of the global population were rulers, religious leaders or merchants. So, while the world may actually be less globalized than we perceive it to be, it is undeniable that it is much flatter than it was.

As the world continues to evolve and the megacities in Asia modernize, the risk transfer market could grow tenfold. As emerging economies shift away from a reliance on a government backstops towards a culture of looking to private market solutions, the amount of risk transferred will increase significantly. The question for the insurance industry is whether it is ready to seize the opportunity.

The number, size, and types of networks are growing and will only continue to do so. Protecting this new interconnected world is our biggest challenge—and the biggest opportunity to lead.