ExposureIQ makes organization-wide portfolio management possible by supporting roll ups across both insurance and reinsurance portfolios in one application, and the robust financial model means complex inwards and outwards reinsurance structures can be applied for a true net of reinsurance view right up to the group level. The in-app dashboard and map allows you to then quickly visualize and report on global exposure concentrations and hotspots.

The future of portfolio management

ExposureIQ™ is an exposure management application that makes organization-wide risk exposure management and event response faster and more accurate for better informed decision-making.

Maximize profitability

Advanced portfolio-level reporting helps you write business closer to your risk threshold.

Strengthen decision-making

Run accumulations across insurance and reinsurance portfolios to identify drivers of loss faster.

Respond faster to catastrophe events

Leverage real-time insights through integration with Moody's RMS Event Response and HWind.

Comprehensive exposure management

An Exposure Manager’s job isn’t done once they’ve balanced their portfolio. At any moment, a catastrophe event can strike, requiring them to support time-sensitive event response operations, like portfolio reporting, and deployment of claims adjusters. Let’s look at how ExposureIQ helps Exposure Managers succeed in the role today and in the future:

Leading up to an event

During an event

Following an event

Sustainable underwriting

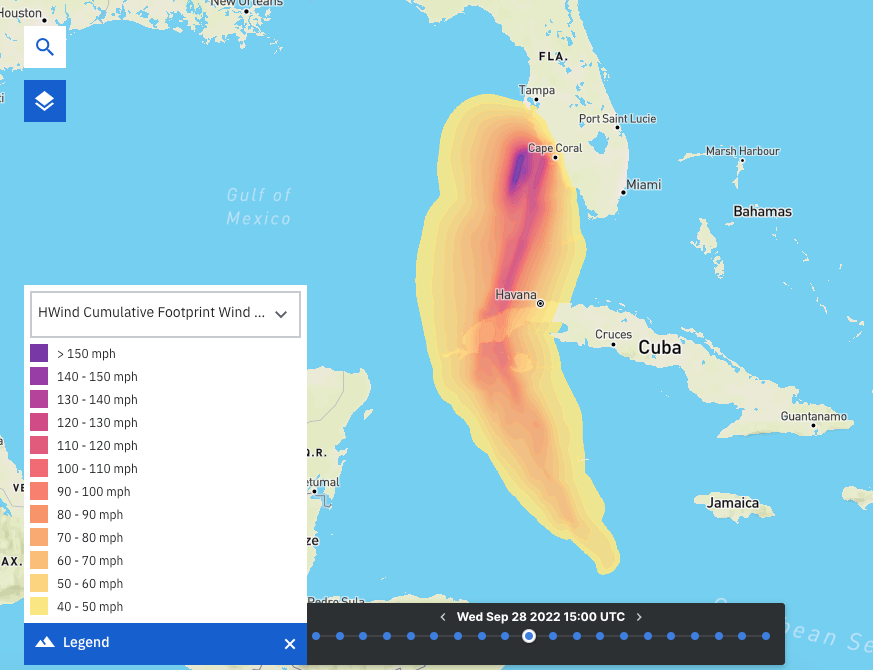

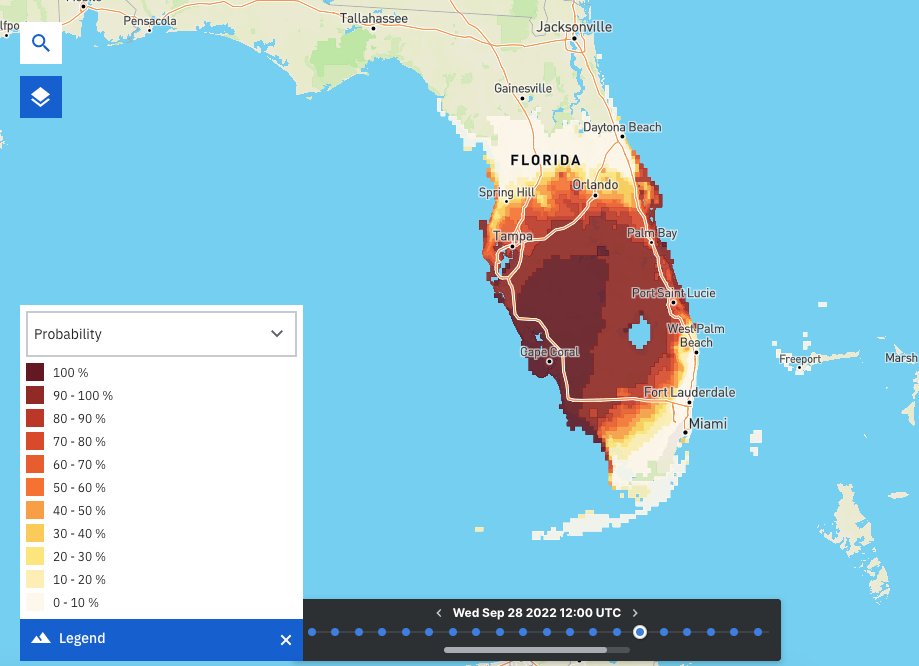

Integrated with ExposureIQ, Moody's RMS HWind provides forecasting products up to 5-days before landfall including seven weighted track scenarios, wind and storm surge footprints, and wind probability analytics updated six times daily.

Every HWind forecast update is instantly made available in ExposureIQ, enabling you to overlay the data onto your portfolio to identify areas and locations most at risk, the associated potential losses and to better inform preparation strategies.

Moody's RMS Event Response footprints and six-hourly HWind snapshots and cumulative wind field footprints are instantly made available for portfolio analysis in ExposureIQ, without the need for manual uploads.

Quantify the potential hazard and loss impacts to your portfolio, produce frequent updates for key stakeholders and anticipate the volume of claims for effective deployment of claims adjusters.

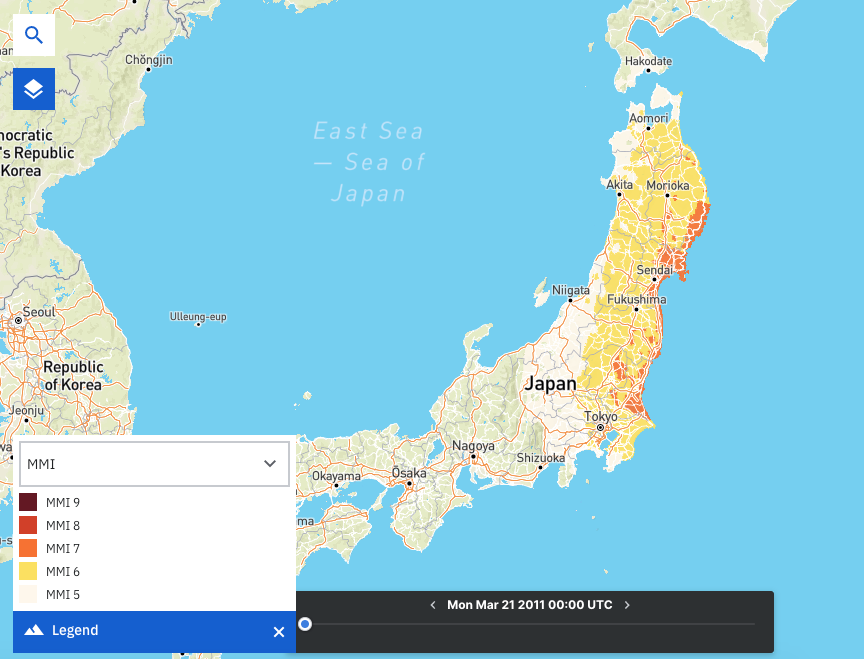

Moody's RMS Global Event Response and HWind footprints are automatically uploaded to ExposureIQ as soon as they become available following an event.

Historical event footprints remain accessible to use on ExposureIQ to help you validate historical claims and loss experience for custom or internal views of risk or to improve event response processes for future events.

With growing societal, governmental, and consumer attention on environmental, social, and governance (ESG), the insurance industry is just beginning to understand how it effects everyday business operations.

ExposureIQ seamlessly incorporates ESG analytics into portfolio and exposure management workflows to improve their risk selection, enhance reporting capabilities, and increase differentiation with new and innovative product offerings.

Customer success stories

Frequently asked questions

What are some of the benefits of a cloud-native architecture for exposure management?

As a cloud-native exposure management application, ExposureIQ has the power and performance to run accumulations on billions of locations and thousands of cedants, empowering you to quickly generate organization-wide views of exposure.

How does ExposureIQ work alongside other applications on the Intelligent Risk Platform?

The open and modular Intelligent Risk Platform delivers unified risk analytics through a trusted data repository, collaborative applications, open APIs, and tools to leverage existing RiskLink integrations.

Resources

Exposure Management: Managing the Complexity of Estimating...

When a catastrophic event such as a hurricane or an earthquake strikes, an insurance business relies on the exposure management team to answer the big questions: What level of loss is the business looking at, how much will be recovered from our reinsurance, and how do we communicate this? In a recent blog for insurers, I looked at the importance of real-time event response and exposure management; in this blog, I will focus on reinsurance and the need to generate net loss figures. For most reinsurers, answeri...

Hurricane Ian: The Challenge of Getting Insights into Your...

As soon as Tropical Storm Ian was named on September 26, 2022, our clients using the RMS® ExposureIQ™ application on the RMS Intelligent Risk Platform, have been accessing both our RMS Event Response event footprints and our RMS HWind real-time insights to provide a unique perspective on the progress of the storm. The ninth named tropical storm of the current North Atlantic hurricane season, Major Hurricane Ian made landfall as a Category 4 (Saffir-Simpson Hurricane Windscale) major hurricane near Cayo Costa,...

Five Challenges Insurers Face to Get an Enterprise-Level V...

For (re)insurers, getting an enterprise-level view of their exposure is essential. It sheds light across the entire book of business – identifying concentrations of risks, portfolio blind spots, and how losses flow through insurance and reinsurance portfolios – especially when an event strikes. With the time, effort, and resources required to produce an enterprise-level view of exposure, the overall result may be inaccurate, not reflect the entire business, or just be out of date. So, what are the five main c...

Exposure Management: Managing the Complexity of Estimating...

When a catastrophic event such as a hurricane or an earthquake strikes, an insurance business relies on the exposure management team to answer the big questions: What level of loss is the business looking at, how much will be recovered from our reinsurance, and how do we communicate this? In a recent blog for insurers, I looked at the importance of real-time event response and exposure management; in this blog, I will focus on reinsurance and the need to generate net loss figures. For most reinsurers, answeri...

Impact of Complex Workflows on Real-Time Event Response (a...

When a potential catastrophic event threatens, exposure managers are on the front line to keep the business informed about potential losses and to identify the impact on insureds and cedants. All eyes are on exposure managers when the business needs regular, near real-time updates on potential losses. Catastrophe risks, such as hurricanes, can be particularly unpredictable, which makes frequent and informed updates mission critical to the business. Just look at Hurricane Irma in 2017. The initial track saw I...

RMS HWind Hurricane Forecasting and Response and ExposureI...

Accessing data in real-time to assess and manage an insurance carrier’s potential liabilities from a loss event remains the holy grail for exposure management teams and is high on a business’ overall wish list A 2021 PwC Pulse Survey of U.S. risk management leaders found that risk executives are increasingly taking advantage of “tech solutions for real-time and automated processes, including dynamic risk monitoring (30 percent), new risk management tech solutions (25 percent), data analytics (24 percent) [and...

Moody's RMS ExposureIQ Explainer Video

Analyze risk concentrations across the entire organization for a comprehensive unified view of risk

Get more powerful insights your way