In my early days with RMS, there were many discussions on options on how we’d design the best next-generation platform for the industry.

However, one thing for me was clear – we were not going to design the applications on this platform just for the users that were going to use them day to day, we also had to design the platform for teams using multiple applications.

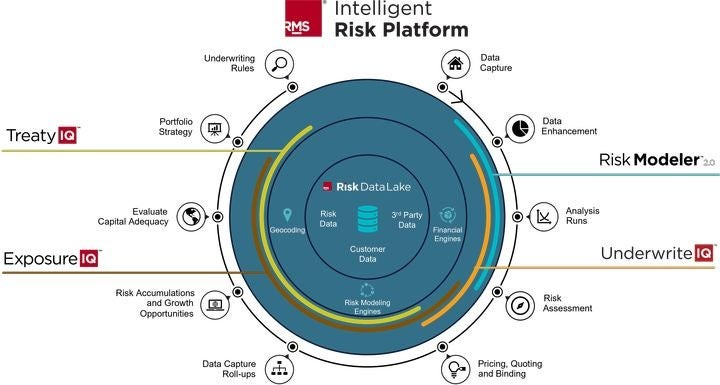

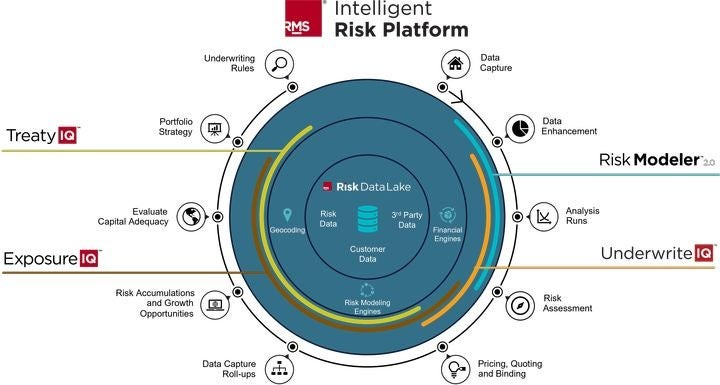

In other words, our customers were not just the users of [Risk Modeler™, ExposureIQ™, UnderwriteIQ™, TreatyIQ™, SiteIQ™] and so on, but also the teams, departments, and groups [insurance, reinsurance, or broker] that use the applications to communicate and collaborate with each other.

In this post, we’ll double-click on examples of how specifically reinsurers are unlocking benefits of the Moody’s RMS Intelligent Risk Platform™ as a collaborative environment.

You will see a few examples of why the applications are built on a ‘unified risk framework’ to ensure applications share numerous services and speak the same ‘data language.’ You can find a similar blog post for insurers here.

I should admit that this kind of dual design across 'users and teams' is NOT an easy endeavor, but I believe this unique advantage of designing around a unified risk framework ensures multiple teams, using different applications, all benefit greatly from the collaborative features that we have built.

Before we dig in, it is important to note we are still in the early days of the Intelligent Risk Platform. Even though we have welcomed over 100 customers that have adopted the platform as of December 2022, there are incoming new customers, new partners with their models, data, and apps, and new applications launching on the platform, and with all those additions, we see new use cases emerge.

First, we start with introducing the applications running on the platform today, all designed for key decision-making disciplines and teams.

- Risk Modeler™: An application designed for catastrophe modelers to help set a company’s risk strategy using risk models. Cat modelers who have used Moody’s RMS RiskLink® will find Risk Modeler quite familiar, and this application includes plenty of enhancements, bringing additional flexibility to model validation and portfolio modeling workflows.

- ExposureIQ™: Designed for exposure managers, ExposureIQ is an application that helps better understand risk concentrations, and hot and cold spots within a portfolio, build ‘what-if‘ analyses, and deliver a detailed understanding of cat events with support for accumulation management pre-, during, and post-event.

- UnderwriteIQ™: Underwriters can access analytics at the point of underwriting using this application, to efficiently price risk using risk models and data. (Please note: UnderwriteIQ is currently only available as a preview for early adopter customers, with general availability in the first half of 2023.)

- Data Bridge: A programmable access endpoint that allows sophisticated users to utilize SQL to access live risk data across multiple applications.

- SiteIQ™: Managing General Agents (MGAs) and cover holders can establish a ‘digital thread’ with their underwriters using this application, to set and align underwriting strategy based on instant risk scores.

- TreatyIQ™: Designed to equip treaty underwriters, TreatyIQ is a model-agnostic application offering flexible program structuring and analytics, along with portfolio monitoring, for better reinsurance pricing and risk selection.

Evaluating More Business in Each Renewal Period

This first workflow describes an example of how reinsurers can utilize the connected nature of the Intelligent Risk Platform to evaluate more business in each renewal season using the Risk Modeler, ExposureIQ, and TreatyIQ applications.

With the ability to evaluate more portfolios, cedants can dramatically increase profitability for a reinsurer. However, inefficient systems that must taxi data back and forth between multiple systems can slow the reinsurance underwriting teams down.

This workflow starts with building the shared business-wide views of all portfolios in ExposureIQ and TreatyIQ. Business-wide views are built to represent treaty programs more realistically, to drive better reinsurance decisions.

In the meantime, cat modeling teams using Risk Modeler, also develop a company’s own view of risk, tuning and tweaking the models to represent risks based on their own experience in each region.

With the shared structures, treaty underwriters using TreatyIQ can quickly take in new cedent portfolios, and import any submitted losses – regardless of which model the insurer/broker used into TreatyIQ.

Thanks to the integrated model execution between TreatyIQ and Risk Modeler, treaty underwriters can also run the portfolios through their own loss evaluation in Risk Modeler using the modeling profiles that represent a reinsurer’s own view of risk.

These integrated analyses help feed better pricing in TreatyIQ and exposure accumulation across the entire cedent portfolio using ExposureIQ as the team evaluates the incoming business.

With the integrated model execution in TreatyIQ, treaty underwriters can select Aggregate Loss Models (ALM), Detailed Loss Models (DLM), or high-definition (HD) models to model the risk with various modeling frameworks to either get a quick evaluation (ALM) and/or evaluate a deeper analysis of top risk drivers (DLM, HD) at the renewal season.

All this efficiency is important in enabling the reinsurance teams to evaluate more business throughout the renewal season and to pick new business opportunities that best fit the existing portfolio.

‘Gold Copies’ of Risk Portfolios

This next workflow also includes TreatyIQ, ExposureIQ, and Risk Modeler working together. This time, instead of stepping on landmines by looking at out-of-date copies of their book of business, teams utilize the single, consistent view of the whole reinsurance portfolio to maximize decision accuracy.

Taking decisions based on an inconsistent view of risk within a company’s business-wide portfolio may lead to costly mistakes. Whether because of choosing new risks that suddenly cause high concentrations of risk, or risks that breach capital allocation objectives, working with inconsistent portfolio views may cause unexpected losses.

As a company’s cedents and portfolios evolve, having a shared understanding – a 'gold copy' of the full list of portfolios – helps to establish better selection, pricing, and marginal impact analyses.

Let’s start with exposure management teams. With access to the company’s full portfolio across all cedants, they can build the rollup structures to help identify the top risk-driving exposures, the clash between various portfolios, and the treaties that are important to diversify using ExposureIQ.

As new business is underwritten by the reinsurer, exposure management teams can rerun the accumulation of risk and compare accumulations over time to set new portfolio optimization targets, watching for risk concentrations in the portfolio and identifying opportunities.

The same rollup structure is shared between ExposureIQ and TreatyIQ. With the full representation of the business across all cedents in TreatyIQ, treaty underwriters can quickly do what-if analyses to evaluate new business. Underwriters select, price, and bid on new business that enhances a reinsurer’s risk profile and capital allocation.

In the meantime, cat modeling teams ensure the reinsurer’s own view of risk is well captured across multiple perils across each one of the portfolios.

Cat modelers can also dig deeper with Data Bridge using SQL to delve into the details of all the portfolios and identify top locations driving risks, to develop a better understanding of the top exposures and losses that can help enhance the what-if analyses treaty underwriting teams run in TreatyIQ.

Unified Event Response

In this third workflow, we’ll look at how multiple teams within a reinsurer responding to a catastrophic event can use ExposureIQ, Risk Modeler, and TreatyIQ to deliver consistent and real-time analytics to assess losses and reassess their risk appetite.

With the company’s full portfolio across all cedants, exposure management teams can build the rollup structures that help accurately represent a company’s entire business in ExposureIQ.

As a hurricane event approaches the coast, before its landfall the exposure management teams can use event forecast footprints from Moody's RMS HWind in ExposureIQ to identify possible portfolios that will be impacted by the event. The refreshed footprints represent the most up-to-date probabilities and losses may materialize based on treaty program terms.

As an event unfolds, cat modeling teams can also run the identified event footprint through Risk Modeler to understand damage estimates with the ability to explore uncertainties around the event using the risk models.

These outputs are directly available in TreatyIQ to help underwriters assess the potential losses which can help steer the future capital allocation, underwriting strategy, and the direction of new business that a team can bid on in the remaining part of the year.

The same event footprints in ExposureIQ combined with the gold copy of the full set of portfolios impacted by the event, allow exposure teams to build a range of damage estimates using factors based on Moody's RMS data or third-party footprints or sources of event information.

Accumulation reports can be prepared using ExposureIQ and then sent to senior executives. As an event unfolds further, any additional feedback enhancing the understanding of the event can be refreshed in ExposureIQ and analyses can be easily regenerated.

Conclusion

These three use cases that we have illustrated represent just a few of the ways we see customers benefiting from connected applications on the Intelligent Risk Platform.

There are many more benefits that simply come from the ability to share settings, profiles, geocoding engines, and currency tables for converting a multitude of currencies across portfolios, all of which create natural consistencies among teams using the platform applications

As a part of the Moody’s RMS team, we are super excited to watch customers discover even more ways to utilize these powers. We are also opening new doors every day for more opportunities, as new applications are delivered from Moody’s RMS, new partners bring their models, data, and applications, and new customers onboard onto the platform.

If you’d like to learn more about the Moody's RMS Intelligent Risk Platform and its applications, please click here.