Key Takeaways

- Significant improvement in exposure data quality via manual and automated augmentation

- More accurate portfolio loss estimates across all perils

- More effective portfolio and capacity management

- Better claims preparedness

The Challenge – Poor Data Quality and Completeness

Moody's RMS was appointed by a leading global MGA underwriting specializing in an extensive range of specialty insurance products to provide a series of data services across the company’s property & casualty portfolio, including portfolio roll-up and reporting.

While working on client data, the Moody's RMS Analytical Services team ran a stringent validation algorithm that comprises of over 800 checks for data quality anomalies. During this check for approximately 500,000 properties, the team noted poor geocoding due to missing address attributes as well as limited and incorrect information on critical building attributes, such as construction type, year built, occupancy, and number of stories.

This shortfall in data quality and completeness reduced the accuracy of modeled results and heighted uncertainty of loss estimates, hence impacting portfolio management and capacity allocation decisions.

The Solution – Data Enrichment Services

The Moody's RMS Analytical Services team flagged these issues with the MGA and conducted a data enrichment process across the portfolio to illustrate the impact on model outcome.

Data quality enhancement is a core service of the Analytical Services team and the team’s combination of scale, expertise, technology, and process efficiency ensures a quick turnaround time, even when enhancing large volumes of location data. The team applied multiple engineering heuristic validations and augmentation processes to the dataset, including both manual and automated procedures, to establish geocode accuracy, remove invalid information for each location, and introduce missing building attributes.

By combining manual and automated processes, the team achieved extensive data enhancements which included:

- Manual data augmentation measures:

- 95 percent to 100 percent enhancement in construction and occupancy data

- 70 percent to 75 percent enhancement in year-built and floor-area data

- Automated Data Quality Toolkit (for U.S. exposures):

- Further 13 percent enhancement in year-built data

- Further 11 percent enhancement in floor area data

- 61 percent enhancement in number of stories data

The Outcome – Improved Portfolio Management and Capacity Planning

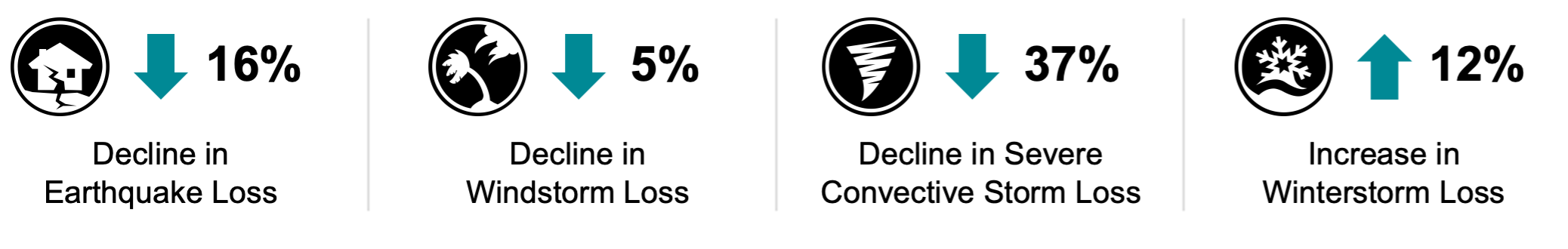

By improving data accuracy and introducing critical building attributes into their property portfolio, the MGA was able to achieve a more accurate loss analysis. As a result of this exercise, the MGA noted a decline in Average Annual Loss (AAL) for Earthquake (16 percent), Windstorm (5 percent) and Severe Convective Storm (37 percent) and an increase for Winterstorm (12 percent) compared to modeled losses using the original data.

Establishing this improved modeled loss accuracy enabled the MGA to adjust the allocation of capacity more effectively. The enhanced data clarity provided a stronger foundation for portfolio management and capacity allocation decisions. It also enhanced claims preparedness through a more accurate event loss analysis.