The Challenge: Grow Flood Insurance Market Share

A leading European regional non-life insurance company undertook a series of strategic initiatives to grow its position in the regional flood insurance market.

The company recognized that to achieve this growth it needed to enhance its existing analytical and modeling capabilities to support improved flood risk selection, greater pricing accuracy, and more effective portfolio management. This would also provide more granular diversification insights and understanding of accumulation risks.

From a workflow perspective, the company needed the new capabilities to integrate seamlessly and efficiently into current risk management tools. In addition, the solution had to be easy to access, with no additional support requirements or infrastructure costs.

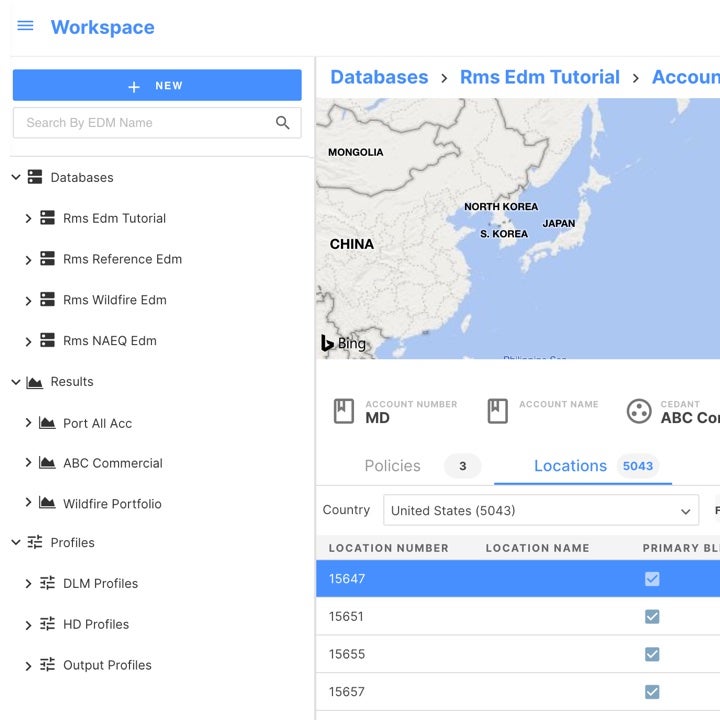

The Solution: Risk Modeler and Europe Inland Flood HD Models

To address these multiple challenges, the company adopted Moody's RMS Risk Modeler™ and Moody's RMS Europe Inland Flood HD Models.

The models provided the enhanced risk insights and high-resolution data required to manage the high-gradient flood peril much more effectively. Risk Modeler also offered advanced portfolio and account risk analyses to meet the complex needs of the company’s risk analysts and cat modelers.

As a cloud-based solution, Risk Modeler not only supported near real-time model execution and an on-demand view of risk, but also enabled straightforward integration, provided a familiar workflow environment, and allowed the company to connect existing applications to the product.

The Outcome: An Expanding Flood Insurance Portfolio

The integration of Risk Modeler into the company’s underwriting and portfolio management ecosystem facilitated several advances on the flood insurance front. These ranged from more risk-appropriate pricing and improved risk selection to better deployment of risk capital and more effective portfolio management.

The combined benefits of HD Models™ delivered via cloud-based Risk Modeler both enhanced underwriting capabilities and improved portfolio management, facilitating premium growth and loss reduction. The new operating environment supported speedy model integration, zero upgrade downtime, and faster model access, with reduced total cost of ownership (TCO) due to no maintenance requirements.

Key Results:

- Risk-appropriate pricing and improved risk selection.

- Speedier model integration and access via a single platform.

- Multiple scale and efficiency benefits of cloud environment.

- Reduced TCO and zero upgrade downtime.