Key Takeaways

- Completed roll-ups 90 times faster, including rolling up 1,000 treaties in 30 minutes.

- Reduced portfolio blind spots for property treaty business by 14%.

- Reduced analysis times by 30 percent.

- Achieved a unified view of risk.

- Optimized risk selection and renewal planning due to enhanced portfolio visibility.

The Challenge – Boost Property Cat Performance

A major global reinsurer wanted to improve the performance of its property catastrophe book by enhancing portfolio management capabilities, improving risk selection practices, refining the deployment of risk capital, and achieving an improved combined ratio.

The company recognized that the analytics underpinning complex transactions was not based on sufficiently accurate and granular data. Further, its ability to generate a comprehensive catastrophe portfolio overview during renewals was severely limited by only being able to produce roll-ups on a quarterly basis.

The reinsurer required a solution that provided underwriters with critical data and real-time insights on overall portfolio impact, no matter how complex the program or which model losses the cedant provided. It also needed to support management with easy access, up-to-the-minute data on aggregated risk positions – particularly during renewal periods.

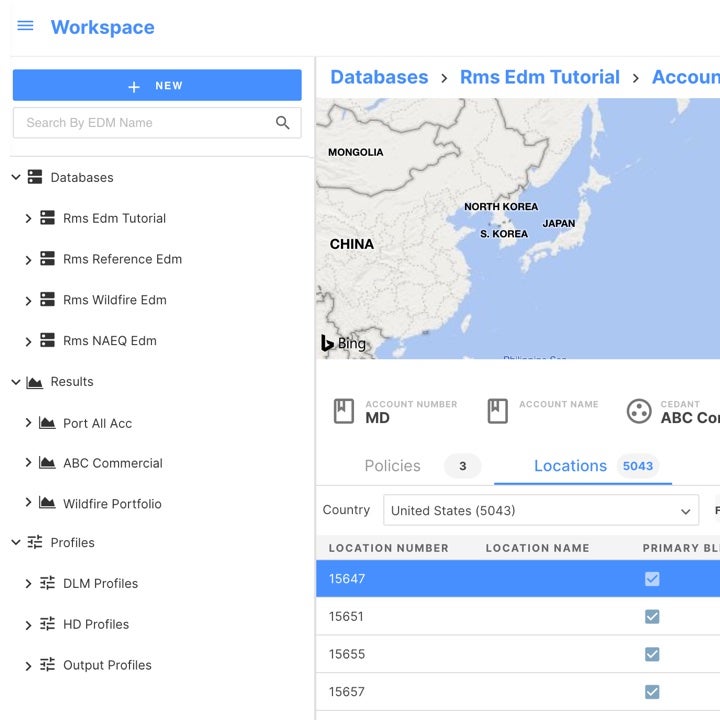

The Solution – TreatyIQ Application

By introducing the Moody's RMS TreatyIQ™ app into the reinsurer’s underwriting framework, the Moody's RMS team was able to deliver risk, profit, and marginal impact insights directly to underwriters across all reinsurance programs.

The intuitive and comprehensive application enabled the company to manage complex and simple treaties quickly, accurately, and with no work-arounds. Cedant losses based on alternative views of risk could be instantly converted to their view of risk using built-in blending capabilities.

The TreatyIQ app also supported the creation of multiple portfolios and a deep-dive loss analysis. By defining clear portfolio criteria, the system allowed for the addition of new treaties that met the criteria with a simple refresh. Additionally, the cloud-based roll-up engine enabled users to monitor and report on aggregate risk positions much more efficiently.

The Outcome – Enhanced Performance and On-Demand View of Risk

Through close collaboration and a seamless introduction of the TreatyIQ app into the underwriting ecosystem, Moody's RMS helped the company achieve a new level of exposure insight and control over their entire portfolio. The application not only delivered an on-demand view of risk but also embedded a unified view of risk.

The company achieved multiple performance enhancements. It was able to roll up 1,000 treaties in 30 minutes, with roll-ups completed 90 times faster than previously possible while analysis times were reduced by 30 percent. The enhanced functionality of the TreatyIQ app also enabled the speedy integration of new pricing methods, while improved portfolio visibility further optimized risk selection and more precise capital allocation. Further, access to much more complete portfolio data reduced portfolio blind spots.