The updated RMS cyber model leverages data, software vulnerabilities, attack scenarios and advanced analytics to help insurers and reinsurers get a handle on their risk aggregations

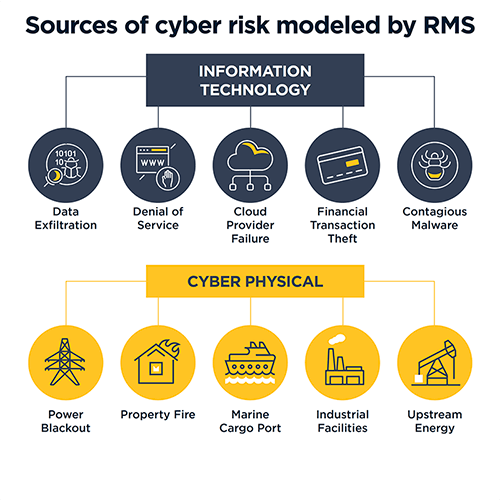

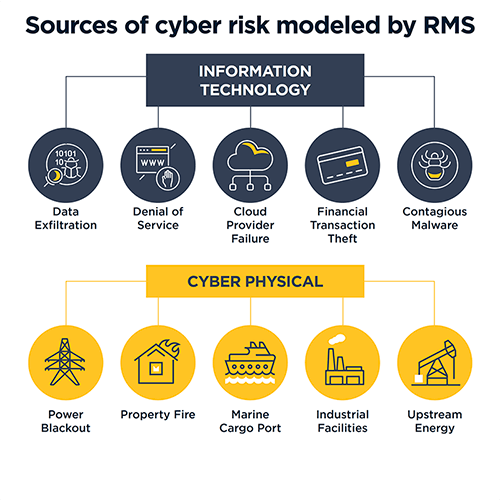

From distributed denial of service (DDoS) attacks, cloud outages and contagious malware through to cyber physical exposures, cyber risk is a sentient and ever-changing threat environment. The cyber insurance market has evolved with the threat, tailoring policies to the exposures most concerning businesses around the world, ranging from data breach to business interruption. But recent events have highlighted the very real potential for systemic risks arising from a cyberattack.

Nowhere was this more obvious than the 2017 WannaCry and NotPetya ransomware attacks. WannaCry affected over 200,000 computers in businesses that spanned industry sectors across 150 countries, including more than 80 National Health Service organizations in the U.K. alone. Had it not been for the discovery of a “kill switch,” the malware would have caused even more disruption and economic loss.

Just a month after WannaCry, NotPetya hit. It used the same weakness within corporate networks as the WannaCry ransomware, but without the ability to jump from one network to another. With another nation-state as the suspected sponsor, this new strain of contagious malware impacted major organizations, including shipping firm Maersk and pharmaceutical company Merck.

Both cyber events highlighted the potential for systemic loss from a single attack, as well as the issues surrounding “silent” cyber cover. The high-profile claims dispute arising between U.S. snack-food giant Mondelez and its property insurer, after the carrier refused a US$100 million claim based on a war exclusion within its policy, fundamentally changed the direction of the insurance market. It resulted in regulators and the industry coming together in a concerted push to clarify whether cyber cover was affirmative or non-affirmative.

The Cyber Black Swan

There are numerous sources of systemic risk arising from a cyber incident. For the cyber (re)insurance market to reach maturity and a stage at which it can offer the limits and capacity now desired by commercial clients, it is first necessary to understand and mitigate these aggregate exposures.

A report published by RMS and the Cambridge Centre for Risk Studies in 2019 found there is increasing potential for systemic failures in IT systems or for systemic exploitation of strategically important technologies. Much of this is the result of an ever more connected world, with a growth in the internet of things (IoT) and reliance on third-party vendors.

Supply chain attacks are a source of systemic risk, which will continue to grow over time with the potential for significant accumulation losses for the insurance industry

As the report states, “Supply chain attacks are a source of systemic risk, which will continue to grow over time with the potential for significant accumulation losses for the insurance industry.” The report also noted that many of the victims of NotPetya were unintentionally harmed by the ransomware, which is believed to have been a politically motivated attack against Ukraine.

Cyber Models Meet Evolving Market Demands

Models and other risk analysis tools have become critical to the ongoing development and growing sophistication of the cyber insurance and reinsurance markets. As the industry continues to adapt its offering, there is demand for models that capture the latest threats and enable a clearer understanding into potential aggregations of risk within carriers’ books of business.

From introducing exclusions on the silent side and developing sophisticated models to understanding the hazard itself and modeling contagious malware as a physical process, we are gaining ever-greater insight into the physics and dynamics of the underlying risk

Dr. Christos Mitas, RMS

As the insurance industry has evolved in its approach to cyber risk, so too has the modeling. Version 4.0 of the RMS Cyber Solutions, released in October 2019, brings together years of extensive research into the underlying processes that underpin cyber risk. It leverages millions of data points and provides expanded data enrichment capabilities on 13 million global companies, leading to improved model accuracy, explains Dr. Christos Mitas, head of the RMS cyber risk modeling group.

“We have been engaging with a couple of dozen clients for the past four years and incorporating features into our solution that speak to the pain points they see in their day-to-day business,” he says. “From introducing exclusions on the silent side and developing sophisticated models to understanding the hazard itself and modeling contagious malware as a physical process, we are gaining ever-greater insight into the physics and dynamics of the underlying risk.”

Feedback over the past six months since the release of Version 4.0 has been extremely positive, says Mitas. “There has been genuine amazement around the data assets we have developed and the modeling framework around which we have organized this data collection effort. There has been a huge effort over the last two years by our data scientists who have been using artificial intelligence (AI) and machine learning (ML) to collect data points from cyber events across all the sources of cyber risk that we model.

“Cyber 4.0 also included new functionality to address software vulnerabilities and motivations of cyber threat actor groups that have been active over the last few years,” he continues. “These are all datasets that we have collected, and they are complemented with third-party sources — including academia, cybersecurity firms, and partners within the insurance industry — into cyber damage events.”

There has been strong support from the reinsurance market, which has been a little bit behind the primary insurance market in developing its cyber product suite. “The reinsurance market has not developed as much as you would expect it to if they were relying on robust models,” says Mitas. “So, we have enhanced reinsurance modeling in our financial engines and exceedance probability (EP) curves to meet this need.

“We’ve had some good feedback from reinsurance pieces we have included in Version 4.0,” he continues. “From a cybersecurity point of view, very sophisticated clients that work with internal cybersecurity teams have commented on the strength of some of our modeling for contagious malware, and for cloud outages and data breach.”

Quoted Source: Barracuda Networks

Click here to learn more about RMS’s purpose-built cyber model