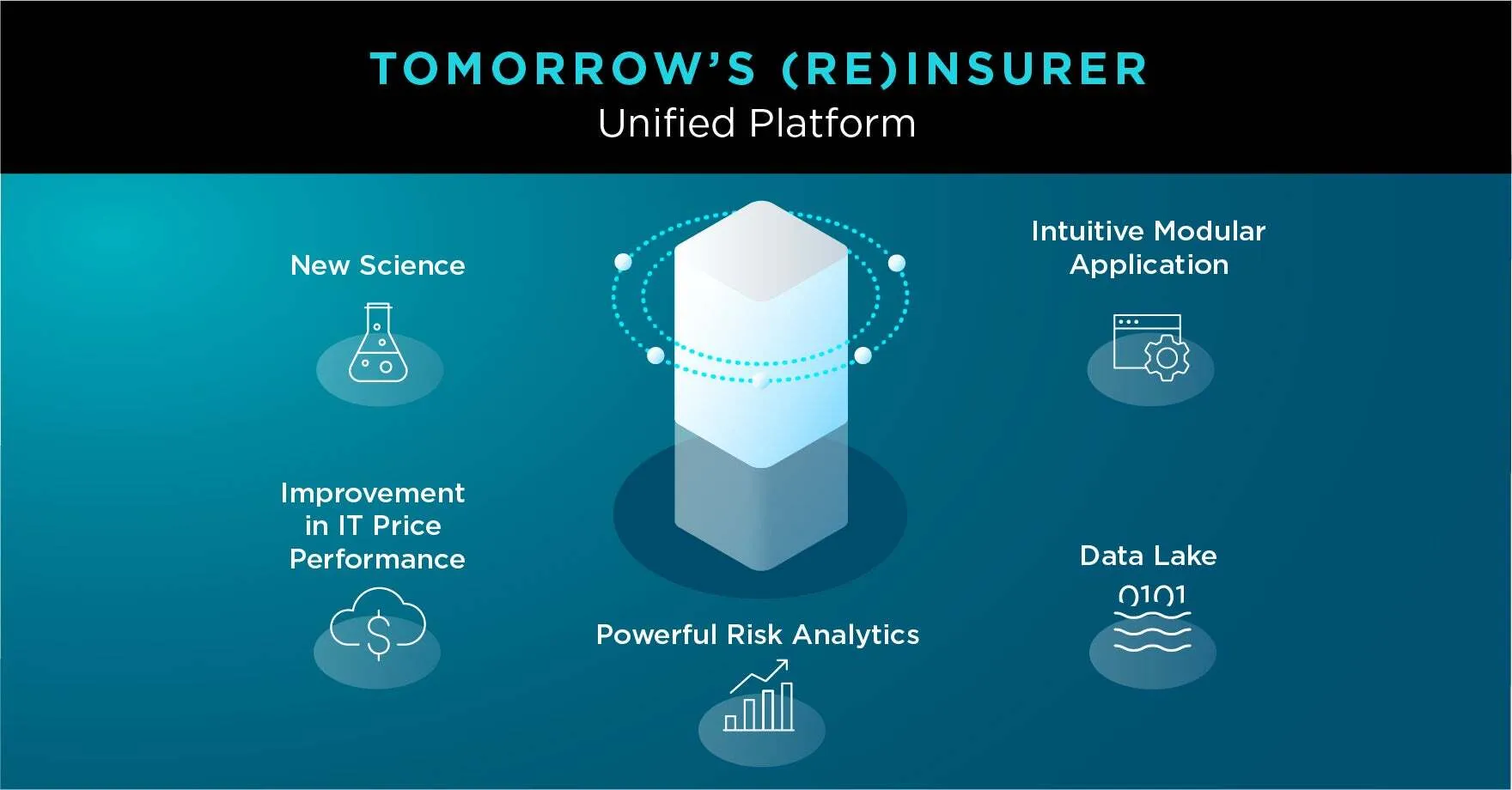

Quickly understand and analyze the independent risk-reward profile of every new deal by comparing anticipated losses with projected income.

Marginal analysis and custom technical pricing capabilities enable you to accurately assess the impact on the live portfolio and adjust pricing based on your own underwriting expertise.