Climate change has been a hot topic in Florida for quite some time. Just last week, President Obama visited the Everglades to discuss the need to address climate change now.

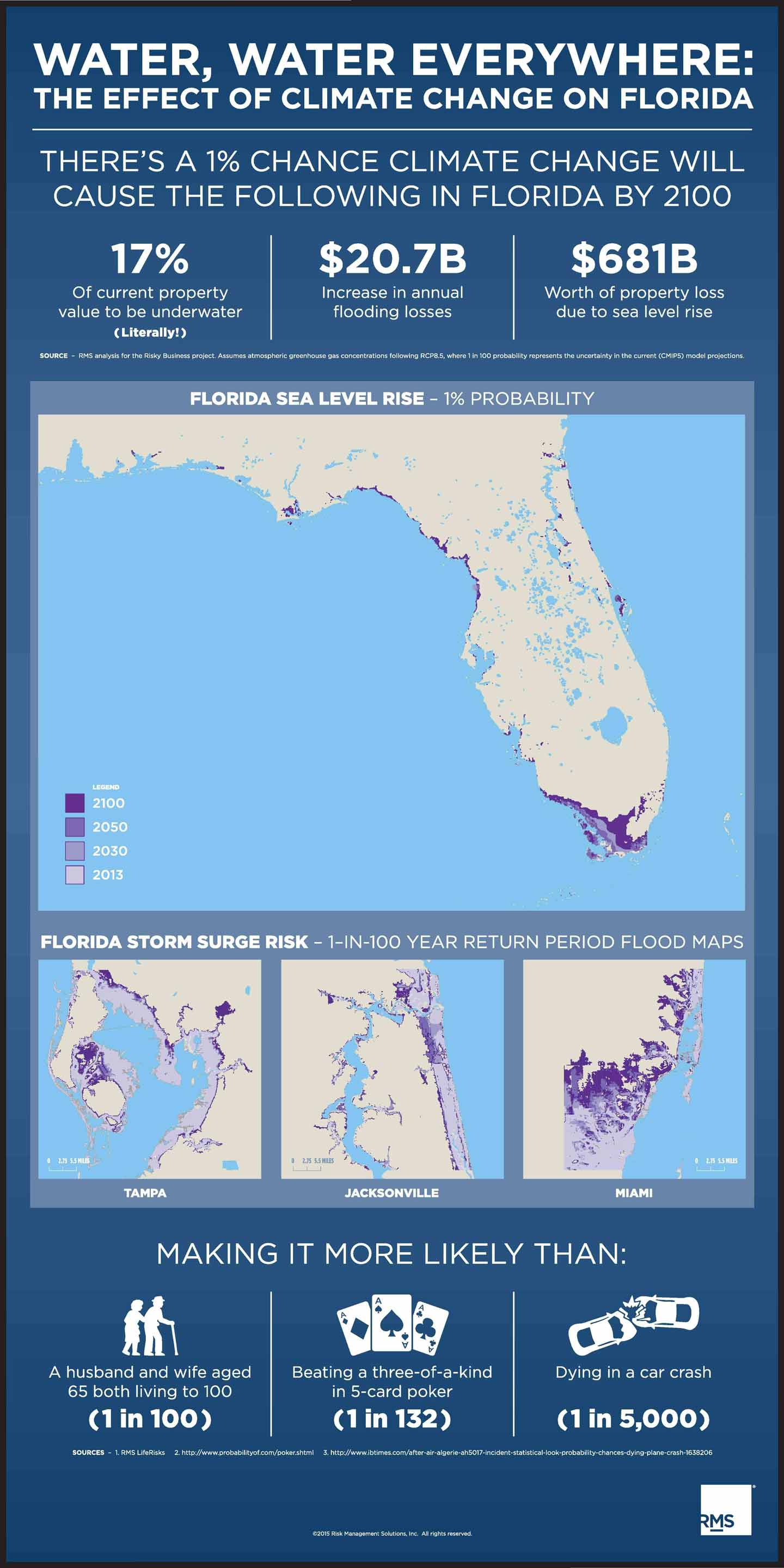

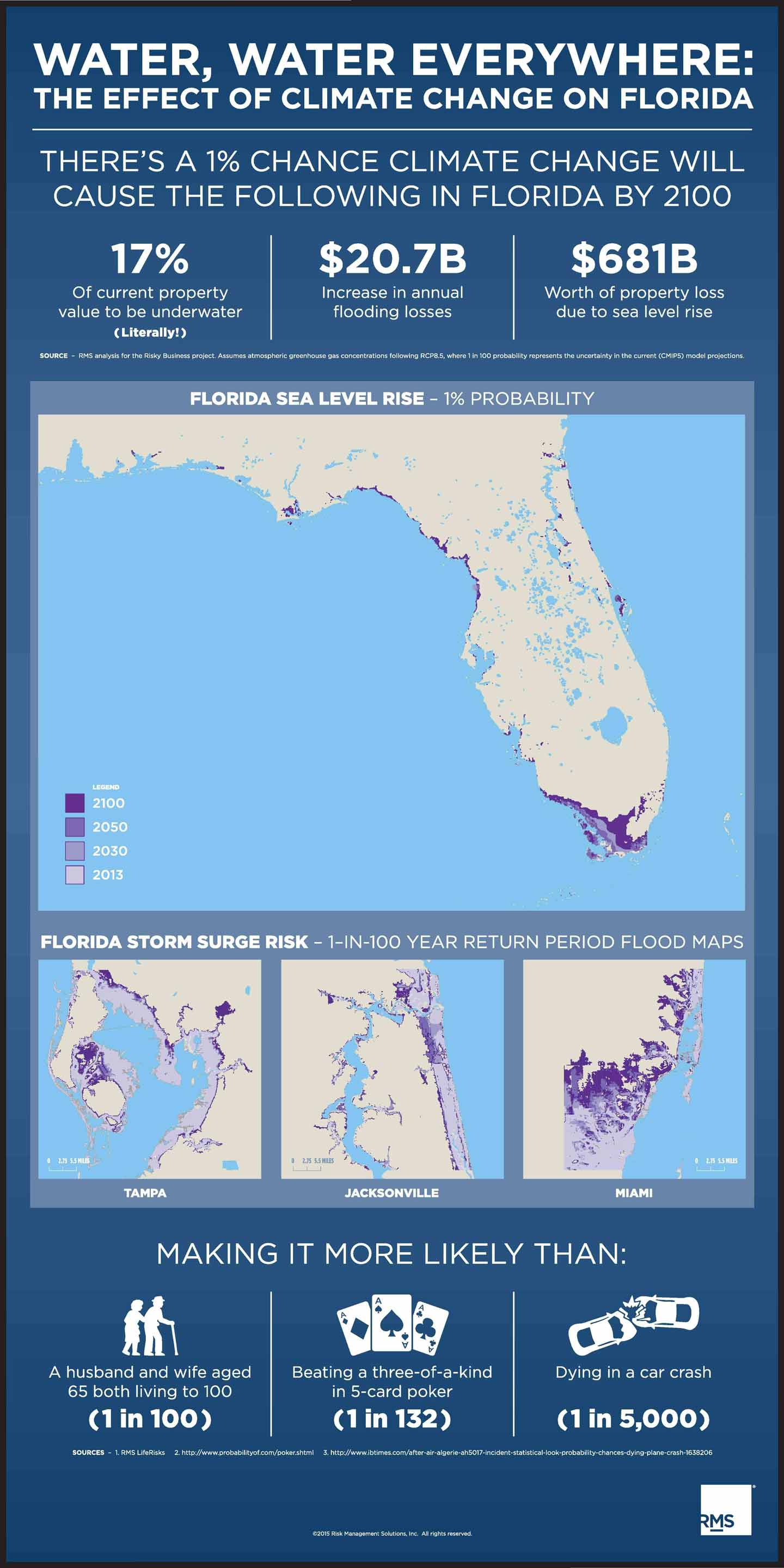

RMS partnered with the Risky Business Initiative to quantify and publicize the economic risks the United States faces from the impacts of a changing climate. In Florida, there is a 1% chance that by 2100, 17% of current Florida property value will be underwater, causing a $20.7 billion increase in annual flooding losses, and $681 billion worth of property loss due to sea level rise.

Bob Correll, principal at the Global Environment Technology Foundation leading the Center for Energy and Climate Solutions: Just last week a report commissioned by the G7 was released to the foreign ministers, including Secretary of State John Kerry, titled “A New Climate for Peace: Taking Action on Climate and Fragility Risk.” It outlines seven things we need to worry about as the changing climate becomes more evident, including sea-level rise and coastal degradation.

Brian Soden, atmospheric sciences professor, University of Miami: Sea level rise is the impact of climate change that I’m most worried about. The rate of sea level rise has almost doubled in Miami over the past decade. We are the canary in the coal mine. If you increase sea level by just three feet, which is in the middle of the range of projections, the Everglades would pretty much be gone.

Robert Muir-Wood, chief research officer, RMS: At RMS we attempt to be completely objective about risk. We attempt to take the full scientific understanding and translate it into information about risk and the associated cost. Financial markets are smart. Future risk is already starting to affect the current value of property.

Matthew Nielson, senior director of global governmental and regulatory affairs, RMS: Regulations generally fall into two buckets: curbing emissions so we can temper this problem and thinking about future development and planning to account for future sea level rise.

But what do we do now? There are a lot of things to think about – one is drainage issues. Another is access to fresh water.

Paul Wilson, senior director of model development and lead modeler for the Risky Business Initiative, RMS: It will be interesting to see how things play out – if the response will come as a result of science and gradual sea level rise, or only after a major catastrophe.

Muir-Wood: It’s very hard for communities to take action until they’ve had a disaster. As we’ve seen with Hurricane Katrina and Superstorm Sandy, suddenly there’s all sorts of enlightened thinking about future risk, such as investments in sea defenses. Unfortunately, it often takes a catastrophe to impact on decisions about mitigating risk.

Paul VanderMarck, chief products officer, RMS: You can only build a sea wall so high before it’s not worth living here anymore.

Soden: The biggest question I ask myself is “when do I sell?”

Correll: A year ago the WEF came to us and asked if we would be willing to work with their young global leaders. We had the head of all Shell operations in the Middle East. We had the former head of GE operations in India. They are getting the message. They walked away saying, “we need to rethink our business plans to plan for the future.”

Modeling provides a lot of the underpinnings to make decisions that are outside of the norm. The past is no longer a prologue to the future.