At the RMS Exceedance 2020 virtual conference in May, we shared with attendees our product release plan covering a number of models. Today, we are delighted to announce the availability of three new models for our customers. Together with the U.S. Wildfire HD Model, these models all use the new high-definition (HD) modeling framework and are available in our Risk Modeler 2.0 application today.

These include:

- Japan Typhoon and Inland Flood HD Model:

- Latest view of risk, incorporating learnings from the 2018-2019 events.

- Differentiation of risk by peril—wind, inland flood and coastal flood, with a complete view of flood risk for typhoon and non-typhoon related flood events.

For a detailed overview of this new model, read our Japan Typhoon and Flood HD Model blog.

- Japan Earthquake and Tsunami HD Model:

- Incorporates latest science and data from 2017 Japan Seismic Hazard Maps.

- Comprehensive view of earthquake risk including shake, fire, liquefaction and landslide plus new integrated probabilistic tsunami model.

You can find a deep dive on this model in our Japan Earthquake and Tsunami HD Model blog.

- Europe Inland Flood HD Models:

- Updates from the original 2016 models, including state-of-the-art inundation methodology.

- More realistic and robust flood footprints provide the most comprehensive and up-to-date view of flood risk for Europe.

More details on this model in our Europe Inland Flood HD Model blog.

Risk Modeler 2.0 with HD Models

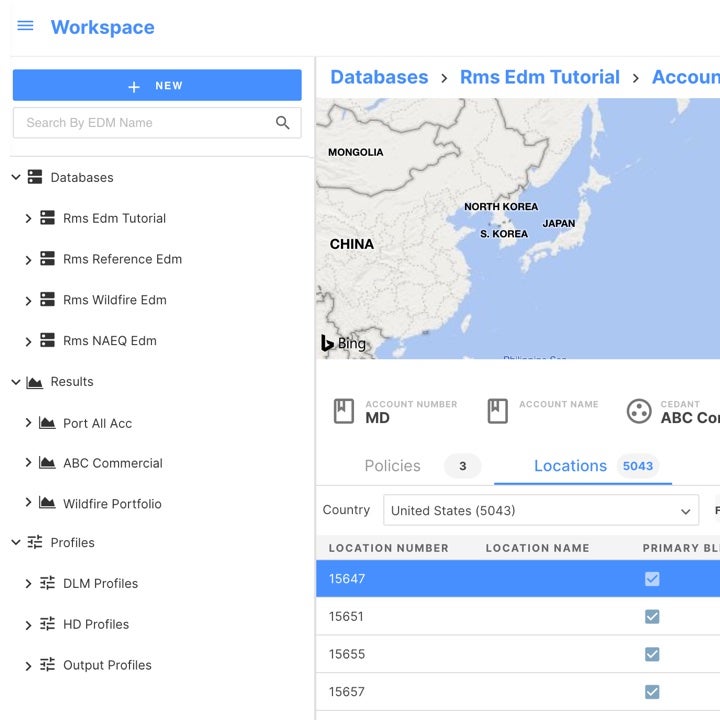

Built on the Risk Intelligence platform, Risk Modeler 2.0 unifies modeling frameworks for seamless access to both HD and the existing RiskLink Detailed Loss Module (DLM) models. Risk Modeler is built to provide access to multiple versions of DLM and HD models side-by-side. Today, multiple versions of DLM models from RiskLink 18.0 and 18.1 sit alongside the HD models released on Risk Modeler 2.0.

Both modeling frameworks use Exposure Data Module (EDM) formatted exposures, making it easy to bring in existing exposures onto the platform. The high-performance cloud environment provides lower latencies in model execution and comes with built-in compliance certifications and total cost of ownership (TCO) savings.

Why HD Models, What Difference Do They Make?

The RiskLink DLM models are efficient, trusted and effective, and will remain as the modeling engine for many of our models, and as mentioned above, RiskLink DLM models are already available on Risk Modeler.

The HD models represent a new evolution for modeling, in tune with the growing sophistication of risk analysis demanded by the market, especially where this granularity is vital to assess a peril—such as flood, wildfire and tsunami, and the data available in the market is of a sufficiently high quality. HD uses a high fidelity, simulation-based framework for modeling event frequency and severity.

Simulation lies at the core of HD modeling, and across the four HD models. For instance, event simulation extends to tens of thousands of years—the U.S. Wildfire HD Model is based on simulated events over 50,000 years. All of this is done to provide a more realistic representation of the hazard, accommodating temporal simulation which reflects real life, such as the ebb and flow of seasons, clustering, or on-the-ground antecedent conditions for flood. Temporal simulation also plays into the financial model to help with terms such as hours clauses.

Another big advantage with HD models is that they bring an accurate reflection of losses at the location coverage level, by peril and sub-peril, rather than aggregating losses. HD model users are able to express all possible terms and conditions in an insurance or reinsurance contract, and can use the enhanced financial model to analyze losses from any contract specification and generate standard YLT (Year Loss Table) and PLT (Period Loss Table) outputs.

For a more general discussion of HD modeling, click on these links to discover five reasons to use HD models and how to make the first steps towards Risk Modeler adoption.