The increasing frequency and intensity of floods in the U.S. over recent years have highlighted the need for holistic risk management solutions to inform decision-making and to price risk more accurately.

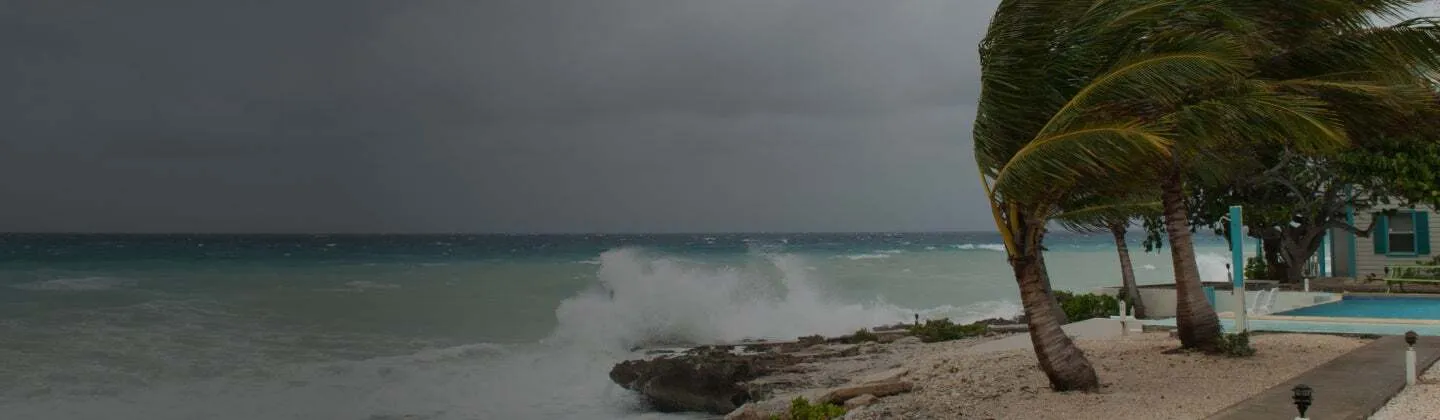

Examining the more recent flood events from 2022 and into early 2023, homeowners and businesses from the Western U.S. through to the Eastern Seaboard found themselves grappling with the devastating consequences of widespread flooding.

These events inflicted hardships on individuals, businesses, and their communities, generating significant economic losses – and substantial insured losses.

From the insured losses stemming from these events, it is interesting to observe the significant variations in losses experienced by the insurance industry.

For instance, in Florida, both coastal and inland regions were ravaged by wind and tropical cyclone-driven flooding resulting from Hurricane Ian in late September 2022, which caused an estimated US$67 billion in insured losses.

During December 2022 and into January 2023, inland areas in California faced the impacts of a sequence of atmospheric rivers resulting in an estimated US$5-7 billion in total U.S. economic losses.

These two events illustrate the complex dynamic between wind and flood perils, coupled with their regional variations, which presents unique challenges for (re)insurers when ensuring comprehensive coverage and effective risk management practices.

The interplay between these two perils requires a thorough understanding of their interactions and the potential impact on insured properties.

Addressing such complexity calls for (re)insurers to employ robust and cross-peril correlated risk assessment models that account for the multifaceted nature of flood events, ensuring comprehensive coverage and effective risk management practices.

Introducing the Moody's RMS U.S. Inland Flood HD Model Version 1.2

The updated Version 1.2 of Moody’s RMS U.S. Inland Flood HD Model has now been released via the Risk Modeler™ application on Moody’s RMS Intelligent Risk Platform™.

The motivation for this update is to ensure continued alignment between the U.S. Inland Flood HD Model and the just-released Version 23 of Moody’s RMS North Atlantic Hurricane Models.

These hurricane models have recently gained approval from the Florida Commission on Hurricane Loss Projection Methodology, for use in residential rate filings with the Florida Office of Insurance Regulation.

The flood model update enables clients to access a comprehensive and current view of hurricane wind and flood risk on Risk Modeler, and the updates in Version 1.2 of the U.S. Inland Flood HD Model include:

- New Simulation Sets for Medium- and Long-term Event Rates in Version 23 North Atlantic Hurricane Models: These additional simulation sets ensure U.S. tropical cyclone inland flood events and embedded storm surge events are aligned with the Version 23 North Atlantic Hurricane Models medium- and long-term event rates (non-clustered view only) for flood-only analyses and when combined with hurricane wind losses.

- New Storm Surge Historical Reconstructions: This includes Hurricanes Dorian (2019), and Delta, Laura, Sally, and Zeta in 2020, which were introduced in the Version 23 North Atlantic Hurricane Models.

- Updated Building Inventory Database for Storm Surge: Aligns with the inventory updates implemented in the Version 23 North Atlantic Hurricane Models database.

- Updated Storm Surge and Tropical Cyclone Inland Flood Post-event Loss Amplification (PLA) Factors: Aligns with Version 23 North Atlantic Hurricane Models, with tropical cyclone inland flood PLA factors updated only for events where hurricane (wind) losses significantly contribute to the overall modeled hurricane event losses, based on factors in the North Atlantic Hurricane Models PLA methodology.

- New Inland Flood Simulation Sets for Non-Tropical Cyclone Flooding Only: These simulation sets complement the existing default (tropical cyclone and non-tropical cyclone) and tropical cyclone-only sets.

- Climate Conditioned Views of the Version 1.2 U.S. Inland Flood HD Model: Accessible via Moody’s RMS Climate Change Models, these models are available as separately licensable extensions to the U.S. Inland Flood HD Models. The climate-conditioned views enable users to develop a standardized view of how climate change impacts their business, based on the best available science.

With such comprehensive and up-to-date risk models, (re)insurers can develop tailored solutions that appropriately address the challenges posed by these interconnected risks, ultimately safeguarding their clients' assets, and promoting resilience in the face of natural catastrophic events.

Find out more about U.S Inland Flood HD Models here, and North Atlantic Hurricane Models here.