If you are responsible for modeling portfolios or accounts, managing risk exposures and concentrations, underwriting insurance or reinsurance for a transaction, or broking risk, you probably know that data engineering complexities impact risk analytics.

Among many challenges, you often have to work with multiple exposure formats (CEDE, OED, and EDM), each with its encoding of exposures, contracts, and treaty terms.

Reflecting greater modeling sophistication, exposure improvements correspond with modeling improvements, with exposure schemas evolving over the years, and the increasing use of new or more granular data to reduce model uncertainty or to better capture tail risk.

This use of multiple schema versions, from older schemas to the very latest (CEDE version 8, 9, 10, EDM version 21, 22, 23, and so on), can then make a complex situation even more complicated.

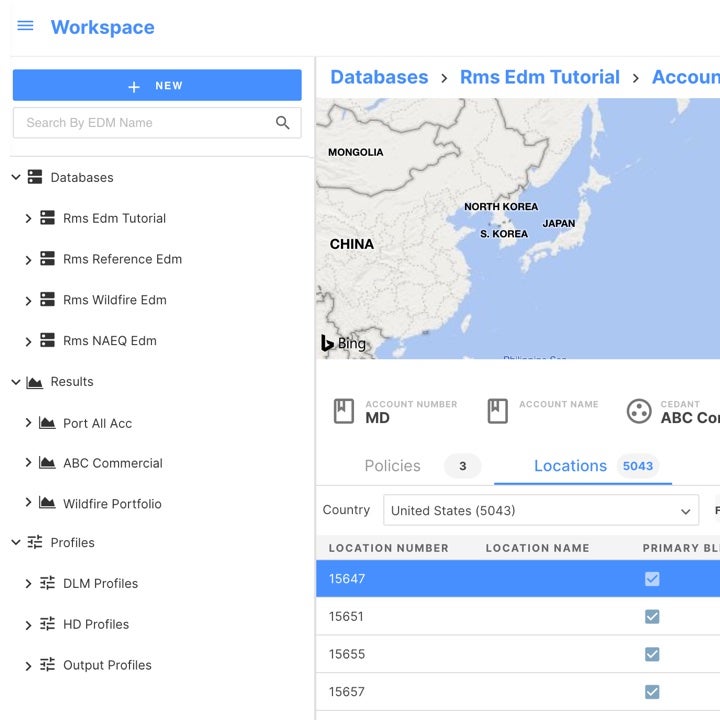

In August 2023, Moody’s RMS released a new Intelligent Risk Platform™ capability to import and transform Catastrophe Exposure Data Exchange (CEDE) databases into the Exposure Data Module (EDM), with initial support for version 10.0 of CEDE database schema (the most recent update).

To help eliminate the complex conversions between versions, we have now introduced support for CEDE data uploads with version 8.0 or 9.0 schemas.

Impact of Data Versioning on Workflows

In an ideal world, firms would update their exposure to the latest version, but the reality is that firms struggle to update their schemas. Modeling software often supports multiple versions of an exposure schema, such as Risk Modeler™ which supports EDM versions as far back as 2013, meaning that the impact of using older exposure schemas is often overlooked.

However, it is when data moves across the insurance value chain, such as during renewal periods, that the data version used can quickly add complexity and cost to your workflow.

Let’s look at just one example:

Imagine you are a reinsurer and have received a portfolio of Florida exposure from a broker using the version 8.0 CEDE schema. Over the past nine months, you’ve carefully crafted your view of hurricane risk based on Version 23 Moody’s RMS North Atlantic Hurricane Model, which only runs on the EDM schema.

In anticipation of the need to convert the schemas, your IT team proactively built a data conversion tool, but it only supports conversion of CEDE versions 9.0 and 10.0.

In this scenario, the data conversion would likely fail and the reinsurer would be faced with several bad options:

- They could try to update their data conversion tool, but that could take months when you factor in the need to validate the results.

- They could pass on the business, which could hurt their growth, or

- They could enlist the broker to run the model, and the firm would forfeit control of the risk insights.

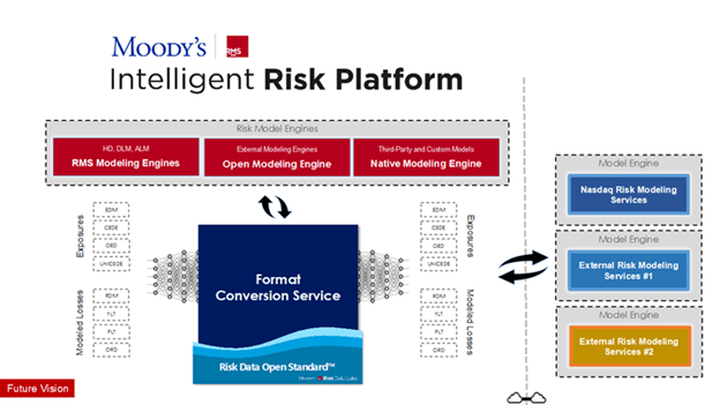

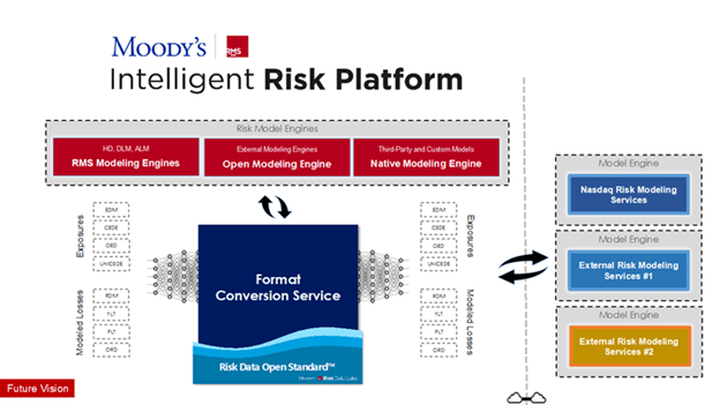

Data Mapping on the Intelligent Risk Platform

Mapping the exposure data, while handling the nuances of the schema versions, is not a trivial task and can place a strain on the resources responsible for developing, testing, and maintaining such mapping engines.

The import engines deployed in Moody’s RMS Intelligent Risk Platform address the complexity of exposure data schema mappings by including multiple versions of these schemas.

Clients no longer need to invest in developing, testing, and maintaining these complex schema mapping tools to deal with multiple versions of EDM, CEDE, and Open Exposure Data (OED) schemas.

A recent Intelligent Risk Platform release expanded the CEDE import engine to support older versions of CEDE database schemas. Clients can now import CEDE databases with schema versions 8.0, 9.0, and 10.0 into the platform.

With the implementation of the Open Modeling Engine, the Intelligent Risk Platform is also expanding the support for exposure schema versions.

Different OASIS models might require exposure to be coded in different OED schemas, with the complexity of coding exposure varying based on what the model supports. This is now all managed by the platform.

For OED schemas, the upcoming platform release also includes support for OED schema versions 2.0 and 3.0. As both CEDE and OED schemas evolve, Moody’s RMS will continue to support conversions of the exposure data.

This provides value to organizations building and maintaining their in-house tools, freeing up your IT teams to focus on high-value tasks.

Achieving High-Fidelity Data Mapping

The mapping services deployed in Moody’s RMS Intelligent Risk Platform are designed to achieve high-fidelity mapping between the various exposure schemas and their various versions.

This high level is achieved through rigorous testing of the mapping engines, by exposing them to many datasets and fine-tuning the mapping logic.

Mapping engines produce multiple reports comparing the key aspects of the exposure data between the source and the destination data schemas to handle cases such as the ones mentioned above.

With the common exposure and loss store at its core and the services to map data from various schemas, the platform makes it easy for clients to access models not only developed by Moody’s RMS but also by multiple other vendors.

It delivers a solution for clients to extend the breadth of their analytics and overcomes the complications of data preparation and data conversion, system integration, and infrastructure plumbing, which hold back multi-vendor model analysis.

Follow the Moody’s RMS blog for the latest Intelligent Risk Platform updates.