In our releases during September, we worked diligently on enhancing Moody's RMS Intelligent Risk Platform™ (IRP) with the implementation of several application updates and workflow improvements.

With the IRP, our goal is to consistently evolve this open, modular, and cloud-native digital foundation that houses Moody’s RMS models, data, applications, and unified risk analytics.

The flexibility offered by the platform enables us to continuously introduce and deploy innovative new products to our users. We have made several significant improvements to the usability of our applications as well as key updates for the TreatyIQ™ application to address workflow challenges of managing treaty programs.

Let’s dig further into the update. We've also made significant strides in transforming OASIS Open Exposure Data (OED) into Exposure Data Module (EDM), a key milestone in addressing the practical challenges of running Moody’s RMS models, client’s home-grown models, and Oasis Loss Modeling Framework (LMF) models on a unified platform.

UnderwriteIQ and Risk Modeler

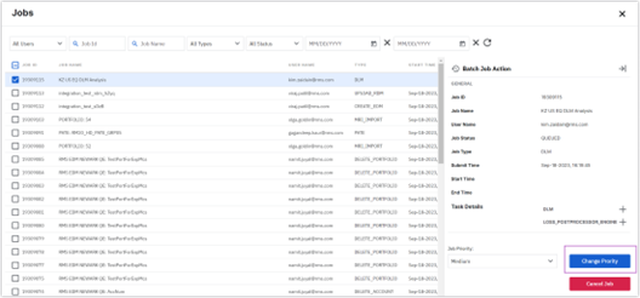

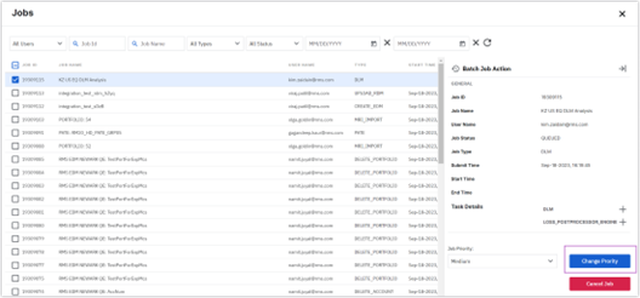

Defining Job Priority and Deleting Multiple Jobs

This update to the Risk Modeler™ and UnderwriteIQ™ applications enhances the job execution workflow to allow certain roles to define the priority of one or more queued jobs.

Users can now define and prioritize modeling jobs using five categories ranging from Very High, High, Medium, Low, or Very Low. This will be particularly helpful during renewal seasons when modelers need to balance the needs of the business and the availability of modeling resources.

In addition, this enhancement also allows users to select multiple queued jobs for cancellation.

ExposureIQ Updates

Export Accumulations Across ExposureIQ Portfolios

This release simplifies cross-portfolio analysis by allowing exports of accumulations from different portfolios to a single ZIP file. Each CSV file within the ZIP file contains the data for a single granularity of output but also includes the results for all portfolios in the export.

Additional Accumulation Filters

A new optional Additional Filters section within the accumulation settings lets users set filters to determine which locations accumulation analyses to include. Users can create filters to include or exclude locations based on several metrics, including the number of stories, occupancy, construction, year built, line of business, and user-defined and user text fields.

Company Matching for Accounts in Portfolio (ExposureIQ Licensed for ESG Data Only)

For clients using the ExposureIQ™ application and licensed for Moody's Environmental, Social, and Governance (ESG) data, when importing portfolios the application attempts to match each account to a company within the Orbis database provided by Bureau van Dijk, a Moody's company.

With this new update, users importing portfolios can now improve the accuracy of imported data by manually matching any unmatched accounts and updating auto-matched ones to more accurate matches if necessary.

Upload an EDM in the .MDF Format

We have added support for uploading EDMs (Exposure Data Modules) in the .MDF (Measurement Data Format) to help capture exposure data in addition to the current BAK format. Users can upload files up to 20 gigabtyes in size, containing a maximum of 10 million locations.

Data Bridge

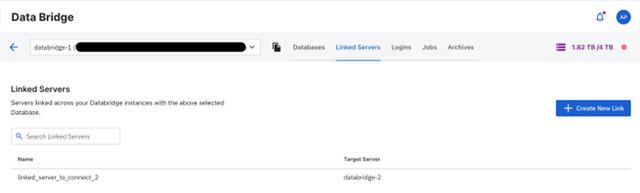

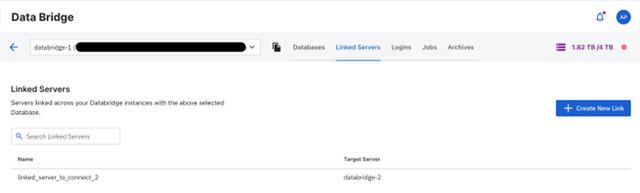

Adding Linked Servers across multiple Data Bridge Instances

Users with a Data Bridge Admin role can now add and delete a Linked Server from one Data Bridge server instance to another instance in their tenancy. To take advantage of this feature, a user’s tenancy must include at least two Data Bridge instances.

Once added, all users with Data Bridge Consumer and Data Bridge Contributor roles can see the list of linked servers and query data across servers if they have access to the respective databases.

UnderwriteIQ

Data Governance Enhancements

UnderwriteIQ administrators can now explicitly share or revoke database access for any groups to which they belong. This sharing allows users to define data access by group for all exposure sets, which includes exposure data from a single EDM and the analysis results associated with those exposures.

In addition, we have simplified the sharing of data by enabling administrators to copy a link to the database and email it to others to give them quick access to the data.

TreatyIQ

Flexible Risk Block Organization

TreatyIQ now allows users to define free-form structure positions known as Risk Blocks.

Using Risk Blocks enables users to group losses together to make it easier to define subjects as well as to report aggregate numbers in the program analysis results. This enhanced grouping feature gives users power over the organization of risk in structures and results.

This update simplifies and delivers the flexibility for users to craft treaty structures, adding to existing capabilities to organize treaties into different columns, and drag-and-drop items into the subject of treaties.

Furthermore, TreatyIQ now supports the editing of previously analyzed programs. Users can save their previously saved version or save edits as a new program. This feature allows users to refine their treaty programs over time and use those programs in portfolios without rebuilding the whole portfolio after program revisions.

New Contract Enhancements

In this release, we have added several enhancements to the contract terms and conditions that users can analyze in TreatyIQ. This includes:

This feature allows you to anticipate the start of the underlying model losses and the exceedance, risk, and loss capability. It also allows TreatyIQ to accurately reflect and model items such as top-and-drop treaties or cascading treaties.

-

Florida Hurricane Cap Fund (FHCF) Templates: TreatyIQ now includes new Florida Hurricane Cat Fund contract templates with predefined occurrences and exclusions.

-

Contract Definition Language (CDL): TreatyIQ now supports customized covers to treaty types using Moody's RMS CDL. For users wanting to customize coverage for a particular type of treaty that is not allowed in the user interface, the use of CDL allows users to override the presets.

Improvements for Managing Business-wide Views

Users can now view treaty programs included in a business hierarchy node by clicking on it and editing the contents of the node from a list of the available treaty programs. Any prime treaties are marked accordingly. Outwards reinsurance nodes now reflect the same functionality and options as inwards reinsurance nodes.

Platform Enhancements

Expanded Data Management Capabilities for Exposure Data Schema across Platform Applications

In the August Intelligent Risk Platform release, we announced that clients that store exposure data in the Catastrophe Exposure Database Exchange (CEDE) data format (Version 10.0) can import and convert this data into an Exposure Data Module (EDM) with Risk Modeler and UnderwriteIQ.

In this release, we have expanded our capabilities to support even more data formats in more IRP applications.

-

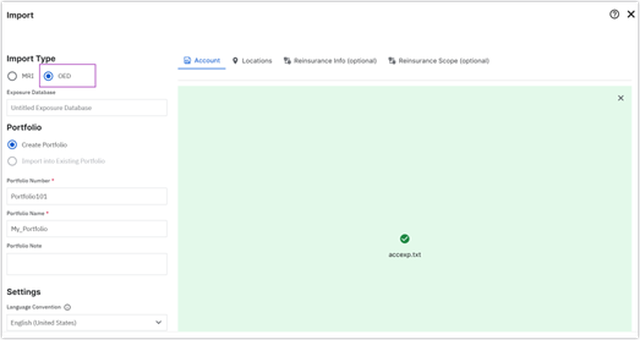

ExposureIQ: Support for CEDE data format (Version 10.0) and the OASIS Open Exposure Data (OED) schema (v1.1.5)

-

UnderwriteIQ: Support for OED schema (v1.1.5)

-

Risk Modeler: Support for OED schema (v1.1.5)

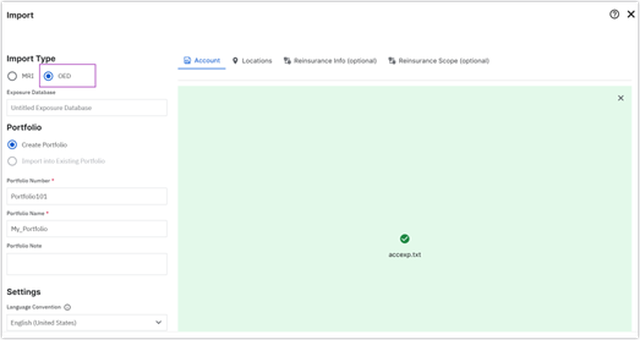

Uploading OED data into the platform will be similar to the MRI import workflow; simply select New > Import in the workspace and select the OED option.

The Intelligent Risk Platform will then seamlessly transform and map an OED into the EDM schema. Once uploaded, this data will be available across all Intelligent Risk Platform Applications that run on exposure data, including Risk Modeler, UnderwriteIQ, and ExposureIQ.

New Intelligent Risk Platform Help Center Integration

This release integrates Moody’s RMS Help Center into Intelligent Risk Platform services, including Risk Modeler, ExposureIQ, TreatyIQ, UnderwriteIQ, and Data Bridge.

Launching the Help Center from the product now directs you to the external ExposureIQ Help Center website, which provides up-to-date product content as changes become available.

This new Help Center supports more detailed information about a specific page than the previous in-app help panels. It also enables users to search or browse the entire Help Center to learn about product features, see how to perform tasks, view application field descriptions, and review previous ‘What's New.’

In addition, it contains the Moody's RMS glossary, reference content, and pertinent database schema and geocoding information.

The PDF versions of the User Guide and current ‘What's New’ document are also still available from Moody's RMS Support Center. Look out for regular updates on the IRP published on this blog.